What is FIRE?

The average American plans to work an average of 45-50 years before retirement. Unfortunately, many will be forced to keep working due to a lack of financial planning, ultimately decreasing their chances of living out their retirement dreams before their health begins to decline.

Then there are those that go against the grain. Unwilling to put the pursuit of happiness on layaway, these rebels flip the script on the traditional path to wealth.

Investopedia defines FIRE (Financial Independence Retire Early) as a “movement of people devoted to a program of extreme savings and investment that aims to allow them to retire far earlier than traditional budgets and retirement plans.”

The average member aims for a savings rate of about 70%. This requires immense discipline and planning. By prioritizing expenses based on value, individuals free up their funds for investing early on and take advantage of compounding interest. In return they have more free time to pursue their passions and to strategize on additional methods for multiplying their money (cha-ching$)!

How is the FIRE community different?

Members of the FIRE community have different priorities to those of the average person.

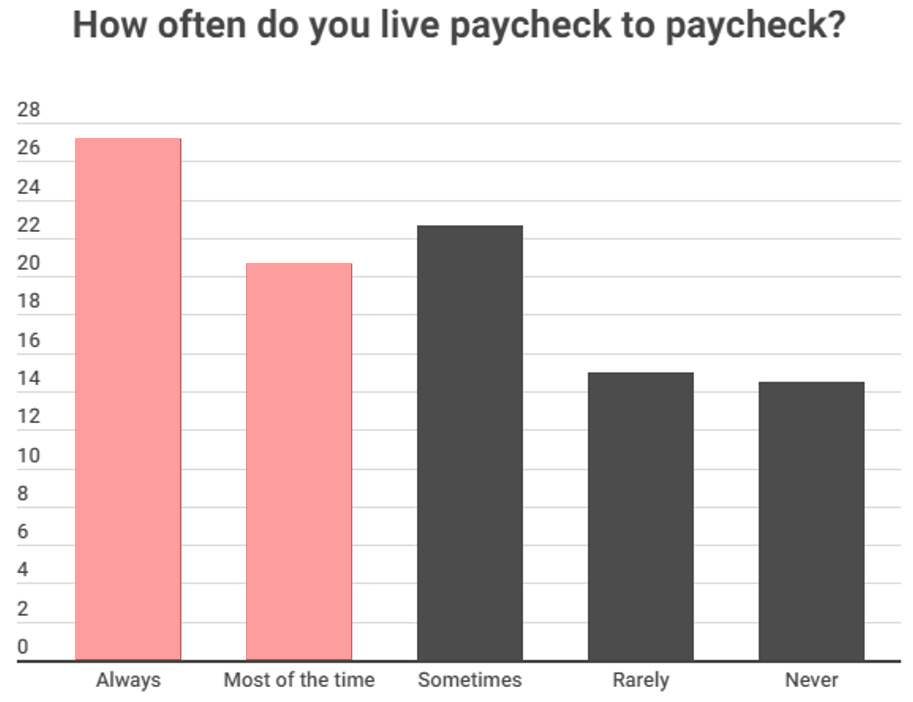

A survey conducted by Intelligent.com in 2022 found that nearly 48% of respondents with college degrees say they live paycheck to paycheck most or all of the time.

Consider the different people you cross on a daily basis that seemingly have it all – a fancy degree, new car, designer shoes, and a big house – 48% of them are at risk of losing everything if they lost their job tomorrow.

Remember the Great Recession of 2008? Hundreds of white-collar workers went broke overnight.

The traditional idea of the American Dream tells us that assuming thousands of dollars in student loans is the key to achieving FI. In reality, this could be the first step towards the golden handcuffs for many.

Is FIRE only for people born rich?

FIRE is obtainable by most people, including immigrants.

According to a study conducted by Fidelity Investments, 81% of millionaires are self-made. Several even came from extreme poverty. Sooo… it’s completely achievable no matter what your background is!

I discovered FIRE in 2021, shortly after purchasing my first house in cash. I was getting ready to close on a second property the following month when I saw a massive whole in my strategy.

It had taken 29 years to amass this wealth. What if it took another 29 years to purchase my next 2 properties?

My search for a faster economies of scale led me to Robert Kiyosaki’s, Rich Dad Poor Dad and eventually the BiggerPockets podcast. Thankfully for me, I already had the extreme savings habit mastered, I just had to expand my investments. Even as an immigrant from a long line of extreme poverty, I was able to apply the concepts of FIRE to scale my real estate portfolio from 0 to 8 units in just 2 years.

Where do I begin if I’m aspiring to FIRE?

There is no cookie-cutter plan to reach FIRE. You should start by setting clear goals and a desired timeline to determine how aggressive a plan you’ll need. Once you define clear goals and a timeline, you can start with what I consider to be the 3 main pillars to achieving financial independence.

3 Pillars of Financial Independence:

- Budgeting {maximize savings & decrease expenses}

- Debt Pay-off

- Investing {increase income & acquire assets}

Admittedly, the second pillar is what I will focus on least as I have never had consumer debt. Read my bio to understand more.

Command these 3 pillars and eventually you’ll reach FIRE!

Key Takeaways

- Assess your starting point and set clear goals.

- Prioritize paying off debt to free up funds for investing.

- The more aggressively you save and invest the sooner you’ll reach FIRE.

Final Conclusion

You don’t need a savings rate of 70% if your goal isn’t to retire early but the rest of this framework is still a great place for anyone to start on their personal finance journey.

If you’re still unsure whether FIRE is for you, just ask yourself the following questions.

- Do you love your job enough to be a slave to it in old age?

- Do you love material items so much (i.e. a big house and a flashy car) that you are willing to trade your golden years for these possessions?

If you answered no to either of those questions, you might unknowingly aspire to FIRE.