Track your Expenses

Knowledge is power. Let’s identify where your money is going so you can be more informed and create a strong budget!

Intro

The Importance of Budgeting

It’s disheartening to see how many people associate budgeting with deprivation & fear. The anxiety of facing their finances often leads individuals to ignore their spending habits until it’s too late.

Have you ever met someone who reached retirement age only to realize they couldn’t afford to retire?

If you’re one of the 77% of Americans feeling anxious about their finances, you’ve probably witnessed similar situations firsthand. According to the American Psychological Association (APA), common signs of financial avoidance include:

- Ignoring money-related thoughts and feelings

- Avoiding discussions about finances with loved ones

- Procrastinating on opening bank statements and credit card bills

- Unfamiliarity with your credit score and net worth

Taking control of your finances starts with understanding your spending habits and creating a budget. By redirecting your money towards your goals, you can alleviate financial anxiety and achieve your dreams. Let’s dive into the steps to create a budget that works for you.

Action

Uncover your Spending Habits

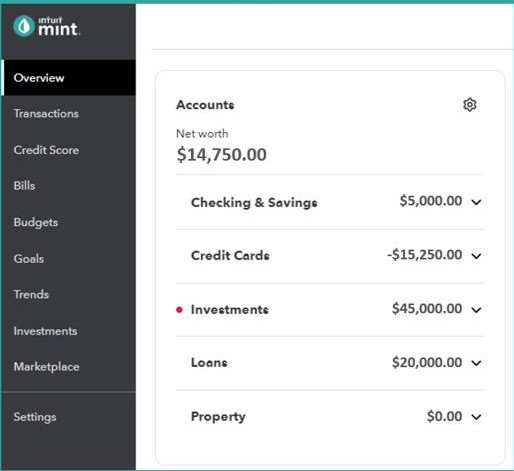

Before tackling a budget, it’s crucial to get a clear picture of your natural spending habits. Thankfully, tools like Mint (mint.intuit.com) make this a breeze. Simply connect your bank accounts, credit cards, investment accounts, and even debt (yes, even that secret credit card you’ve been hiding!). Mint offers a free version with everything you need: a snapshot of your expenses, debt, and an estimated net worth.

Don’t panic, be honest! Don’t let a low or negative net worth discourage you. The goal here is complete transparency. Fudging numbers or hiding accounts only hurts you in the long run.

See an example from our fictional friend, Sarah to the left.

If you’re comfortable with technology, apps like Mint can streamline this process. However, if you prefer a more manual approach, you can export the past 3 months’ statements from each of your accounts. While a bit tedious, it’s definitely time well spent.

Categorize your Expenses

Many budgeting apps automatically categorize your expenses, but it’s important to review these categories and make adjustments as needed. For instance, if you’re reimbursed for work-related expenses, you might want to categorize them as “Reimbursable Income” to accurately reflect your net income.

To gain a clearer picture of your spending habits, group your expense categories into three main buckets:

01

Essential

These are the non-negotiables like housing, food, transportation & utilities. Reducing these costs may require significant lifestyle changes.

02

Non-Essential

All other expenses are considered discretionary, or non-essential, like shopping, entertainment, gym, & hobbies. This is often the easiest place to make cuts.

03

Priorities

Budgeting isn’t all about restriction; it’s also about prioritizing what matters most! Choose 2 non-essential expenses, no more than 3, that bring you joy and allocate a specific budget to them.

By categorizing your expenses, you can identify areas where you can cut back and prioritize your spending.

Create an Analysis

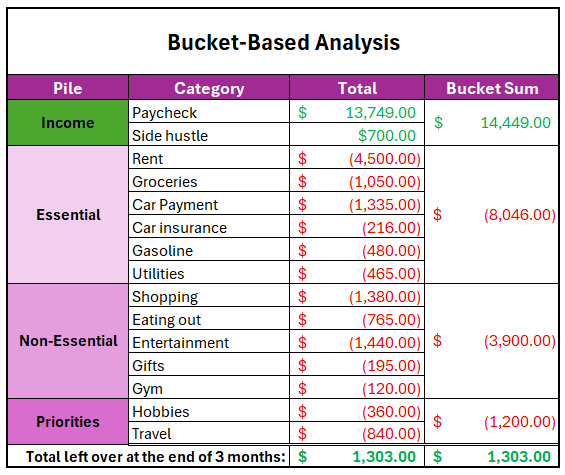

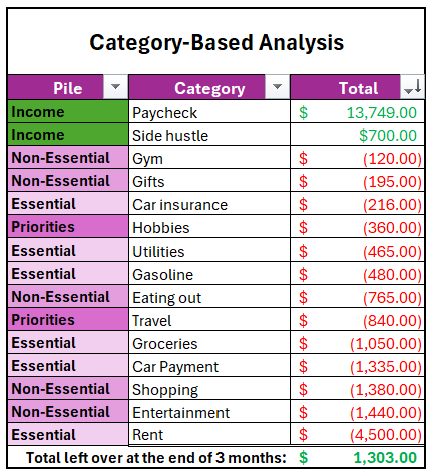

To gain a comprehensive understanding of your financial habits, export a detailed report of the past three months of income and expenses in Excel format. This data can be analyzed using a pivot table, which allows you to visualize your spending patterns and identify areas for potential savings.

Pivot Table Options:

- Piled-Based Analysis: By grouping expenses into categories like “Essential,” “Non-Essential,” and “Priorities,” you can quickly assess the overall allocation of your funds.

- Category-Based Analysis: Focusing on individual expense categories, such as “shopping” or “entertainment,” can help you pinpoint specific areas where you may be overspending.

While both methods provide valuable insights, a combination of both approaches often yields the most comprehensive understanding of your financial habits. By analyzing your data from multiple perspectives, you can make informed decisions about where to cut back and where to allocate your resources.

Assess your Situation

How did your expenses fare?

Compare Income to Expenses:

Start by comparing your total income to your total expenses. If you spent more than you earned, consider the reasons behind it. Was it due to an unexpected expense, or is this a recurring pattern? To get a more accurate picture, analyze six months of financial data. Consistent overspending is a clear sign that adjustments need to be made.

Evaluate your Surplus:

If your income surpasses your expenses, congratulations! However, it’s important to reflect on how you’re utilizing this surplus. Is it sufficient to achieve your financial goals, or is it merely enough to avoid financial emergencies? Be mindful of hoarding tendencies that may prevent you from enjoying life to the fullest.

Conclusion

Both extremes—extreme frugality and reckless spending—can lead to financial stress. A balanced approach, however, can help you achieve your financial goals without sacrificing your quality of life. By creating a well-crafted budget, you can reduce unnecessary expenses and allocate your funds towards savings, debt repayment, and investments.

Optimize

Continue developing your skills in the next post

Have Questions?

Frequently Asked

Questions

How do I know if I am overspending?

If your monthly expenses surpass 80% of your monthly income, you might be overspending.

What if I am overspending?

It’s critical that you identify the categories you’re overspending in and adjust spending limits so you can increase savings and pay down debt ASAP.

How do I choose my priorities?

Think value-added “wants” that will make this journey miserable if you fully eliminate them. Examples could include workout classes or travel.

How often should I track my budget adherence?

Depends, how often you need to stay consistent. Try starting with monthly check-ins to ensure your adhering to the set budget and move to bi-monthly or quarterly as it becomes more natural.

How many categories should I have?

Depends how detailed you want to get. I love details but also value simplicity, so I keep it to less than 12. Read my post on “A Deep Dive into Budgeting” to learn more.

How much should I budget for investing?

There is no one-size-fits-all but you should cross certain milestones first. Continue to the “Increase Savings” section of the Path to FIRE menu to learn more.

Still have questions?

Let’s talk!

1 thought on “How to Create a Budget”

Comments are closed.