Make a Plan

Now that you’ve gained clarity on your spending habits, it’s time to create a personalized budget with the 50/30/20 method.

Intro

In our previous article we delved into the importance of understanding your spending habits. Now, it’s time to put that knowledge into action. Let’s dive into the 50/30/20 budget plan, a simple yet effective method to allocate your income.

The 50/30/20 Budget Breakdown

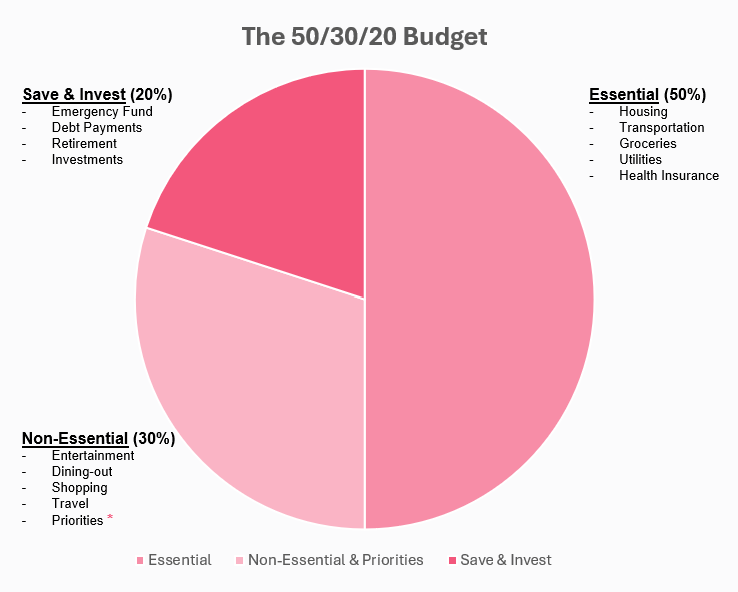

The 50/30/20 budget suggests dividing your income into 3 buckets:

- 50% Essential: Covers needs like housing, food, utilities, and transportation.

- 30% Non-Essential: Includes discretionary spending on entertainment, dining out, and hobbies.

- 20% Save & Invest: Entails savings, investments and debt repayment.

By limiting 50% of your income on Essentials, and 30% on non-Essentials, you’re left over with 20% to redirect towards future goals.

Adapting the 50/30/20 Budget to Your Lifestyle

While the 50/30/20 budget is a solid starting point, it’s important to tailor it to your specific financial goals and lifestyle. For instance, if you’re saving for a significant purchase or early retirement, you might consider increasing your savings percentage to 30% or even 40%.

Key Considerations for Budgeting Success

- Emergency Fund: Prioritize building an emergency fund of 3-6 months’ worth of living expenses. Once established, you can redirect these funds towards other financial goals.

- Prioritize Your Goals: Identify your financial goals and allocate funds accordingly. Whether it’s buying a home, starting a business, or retiring early, having clear goals will help you stay motivated.

- Cut Back on Non-Essential Expenses: Consider reducing expenses like dining out, shopping, and entertainment. Small changes can add up to significant savings.

- Review and Adjust: Regularly review your budget to ensure it aligns with your changing financial situation and goals. Be flexible and willing to adjust as needed.

For help reducing unnecessary expenses, read my article 15 Tips to Slash your Expenses.

Conclusion

Don’t be discouraged if a 20% savings rate seems daunting. Saving, like any habit, takes practice.

Start small by trimming non-essential expenses. If your essentials exceed 50% of your total income or you’re burdened by debt, a more aggressive strategy may be necessary. It won’t be easy at first, but every sacrifice brings you closer to financial freedom.

Optimize

Discover more aggressive saving strategies

Have Questions?

Frequently Asked

Questions

How can I stick to my budget?

Regularly check in on your spending habits. IF you find yourself straying from your plan, consider using cash or a debit card with a limited balance to help you stay on track.

How can I budget for unexpected expenses?

Having an emergency fund is crucial. Additionally, having liquid assets like a brokerage account can provide a financial cushion for unforeseen circumstances.

How can I budget for a wedding?

Read my article “FIRE and the Fantasy Wedding” for tips on creating a realistic wedding budget that aligns with your financial goals.

How can I budget for long-term goals?

Start by defining your goals and calculate their cost. Then, determine the best investment vehicles based on your timeline and risk tolerance. Consider options like high-yield savings accounts, brokerage accounts, and real estate investments.

How can I budget for irregular income?

Use a conservative estimate of your average monthly income over the past 6 to 12 months. When dealing with fluctuating income, it’s better to underestimate your earnings to avoid overspending.

How can I budget to pay off debt faster?

To accelerate debt repayment, focus on reducing expenses and increasing your income. Consider taking on a side hustle or negotiating lower interest rates with your creditors.

Still have questions?

Let’s talk!

1 thought on “The 50/30/20 Budget Plan”

Comments are closed.